Audit

Audit

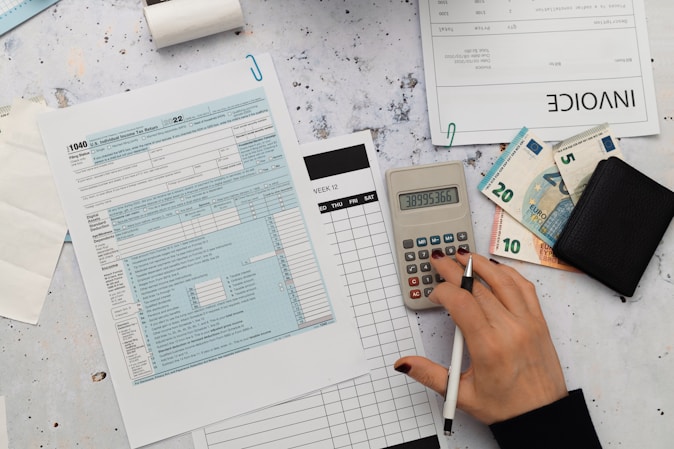

Audit services in the UAE provide independent examination of financial statements to verify accuracy, compliance with accounting standards, and adherence to regulatory requirements. Statutory audits are mandatory for many businesses under UAE Commercial Companies Law and specific free zone regulations.

Let’s Work Together!

Please provide the details below to help us understand your requirements better. Our team will review your request and get back to you as soon as possible

Explore Our Blog

FAQ

How long does business setup take in Dubai?

Company formation typically takes 3-7 business days once all documents are submitted. The complete process including visa and bank account opening usually takes 3-4 weeks.

What are the costs involved?

Costs vary based on jurisdiction, business activity, and visa requirements. Packages start from AED 15,000 for free zone companies. We provide transparent pricing with no hidden fees.

How difficult is it to open a bank account?

UAE banks have strict requirements, but our established relationships and expert guidance ensure high success rates. We prepare your application and accompany you to bank meetings.

What about taxes?

UAE offers 0% personal income tax. Corporate tax is 9% on profits above AED 375,000. Free zone companies may qualify for tax exemptions. VAT is 5% for applicable transactions.

What ongoing services do you provide?

We offer accounting, VAT services, corporate tax filing, audit support, license renewals, visa renewals, and ongoing compliance management.